Date: October 13, 2021

Table of Contents

Project Planning

✓ 🟢 Plan ➜ ☐ Acquire ➜ ☐ Prepare ➜ ☐ Explore ➜ ☐ Model ➜ ☐ Deliver

Project Objectives

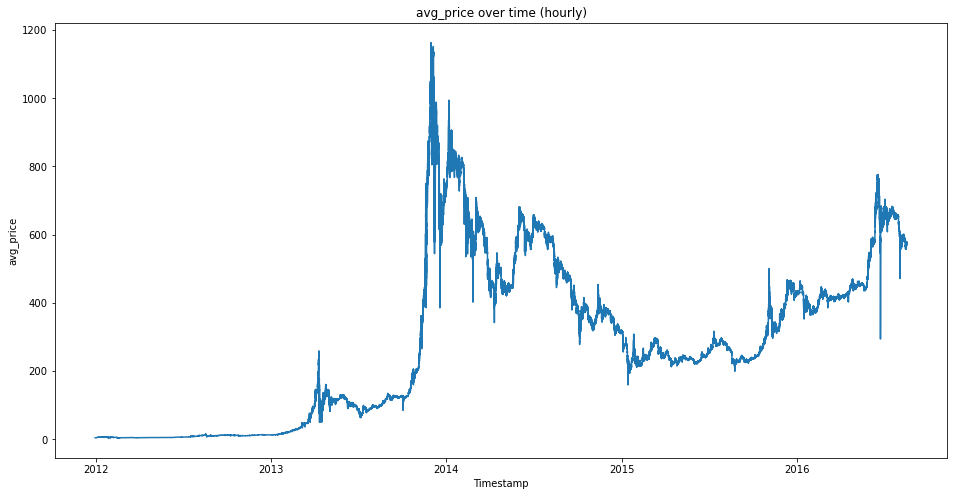

- For this project we will be working with historical price and volume data from Bitcoin between 01-01-2012 & 03-31-2021, these are Bitstamp prices and all are annotated in USD.

- The primary focus is to see if Bitcoin price can be predicted with any reliability or if there is any cyclical observations within Bitcoin pricing or volume.

- The csv data can be downloaded from Kaggle here.

Business Goals

- Create models that are better at predicting Bitcoin price than the baseline.

- Put these models into a Juypter notebook and make the project replicable.

Audience

- Data science professionals as well as any curious cat.

Deliverables

- A clearly named final notebook. This notebook will be what you present and should contain plenty of markdown documentation and cleaned up code.

- A README that explains what the project is, how to reproduce you work, and your notes from project planning.

- A Python module or modules that automate the data acquisistion and preparation process. These modules should be imported and used in your final notebook.

Executive Summary

Goals

- This project is to utilize machine learning modeling to predict the avgerage price of Bitcoin, better than the baseline.

- Abstract the functions to sub python scripts to have a clean presentation, and throughly document.

Findings

- The dataset had quite a few null values, but utilizing a forward fill method offered an easy and effective remedy. Otherwise, this dataset was quite clean.

- Another key aspect of predicting Bitcoin’s price was the percent change within a time interval.

- The best performing model was Holt’s Linear Trend that was fine tuned for the dataset via slope and level smoothness, with an RMSE of 53.

Acquire Data

✓ Plan ➜ 🟢 Acquire ➜ ☐ Prepare ➜ ☐ Explore ➜ ☐ Model ➜ ☐ Deliver

Data Tail

| Timestamp | Open | High | Low | Close | Volume_(BTC) | Volume_(Currency) | Weighted_Price |

|---|---|---|---|---|---|---|---|

| 2021-03-30 23:56:00 | 58714.3 | 58714.3 | 58686 | 58686 | 1.38449 | 81259.4 | 58692.8 |

| 2021-03-30 23:57:00 | 58684 | 58693.4 | 58684 | 58685.8 | 7.29485 | 428158 | 58693.2 |

| 2021-03-30 23:58:00 | 58693.4 | 58723.8 | 58693.4 | 58723.8 | 1.70568 | 100117 | 58696.2 |

| 2021-03-30 23:59:00 | 58742.2 | 58770.4 | 58742.2 | 58760.6 | 0.720415 | 42333 | 58761.9 |

| 2021-03-31 00:00:00 | 58767.8 | 58778.2 | 58756 | 58778.2 | 2.71283 | 159418 | 58764.3 |

Data Dictonary

| Feature | Datatype | Definition |

|---|---|---|

| Timestamp | 4857377 non-null: datetime64[ns] | start tiem of time window (60s window), in Unix Time |

| Open | 3613769 non-null: float64 | Open price at start time window |

| High | 3613769 non-null: float64 | High price within the time window |

| Low | 3613769 non-null: float64 | Low price within the time window |

| Close | 3613769 non-null: float64 | Close price at the end of the time window |

| Volume_(BTC) | 3613769 non-null: float64 | Volume of BTC transacted in this window |

| Volume_(Currency) | 3613769 non-null: float64 | Volume of corresponding currency transacted in this window |

| Weighted_Price | 3613769 non-null: float64 | VWAP - Volume Weighted Average Price |

Takeaways from Acquire:

- Target variable:

avg_price- This dataframe currenly has 4,857,377 rows and 8 columns

- There are 1,243,608 missing values.

- All columns are float64 types of data.

Prepare Data

✓ Plan ➜ ✓ Acquire ➜ 🟢 Prepare ➜ ☐ Explore ➜ ☐ Model ➜ ☐ Deliver

- Add additional columns of

month,day_of_week,price_diff,price_delta,percent_changeandday_num.- Filling the null values with the most recent value will likely be the best course of action.

New Data Dictionary

| Feature | Datatype | Definition |

|---|---|---|

| Open | 4857377 non-null: float64 | Open price at start time window |

| High | 4857377 non-null: float64 | High price within the time window |

| Low | 4857377 non-null: float64 | Low price within the time window |

| Close | 4857377 non-null: float64 | Close price at the end of the time window |

| Volume_(BTC) | 4857377 non-null: float64 | Volume of BTC transacted in this window |

| Volume_(Currency) | 4857377 non-null: float64 | Volume of corresponding currency transacted in this window |

| Weighted_Price | 4857377 non-null: float64 | VWAP - Volume Weighted Average Price |

| day_of_week | 4857377 non-null: object | Verbose name of the week |

| day_of_week_num | 4857377 non-null: int64 | number representing the day of the week |

| month | 4857377 non-null: object | Month number and month name |

| month_num | 4857377 non-null: int64 | number representing the month of the year |

| price_diff | 4857377 non-null: float64 | Delta between the Close and Open (Close - Open) |

| price_delta | 4857377 non-null: float64 | Delta between the High and Low (High - Low) |

| day_num | 4857377 non-null: int64 | The numeric number of the day of the month |

| avg_price | 4857377 non-null: float64 | Avg price for the time period ([Open + Close] / 2) |

| percent_change | 4857377 non-null: float64 | Price difference / Open price represented as a percentage (price_diff / Open) |

Prepare Takeaways

- The data is now prepared to be input into the explore aspects of the data pipeline to evaluate what features we should use to potentially run time-series analysis on.

Explore Data

✓ Plan ➜ ✓ Acquire ➜ ✓ Prepare ➜ 🟢 Explore ➜ ☐ Model ➜ ☐ Deliver

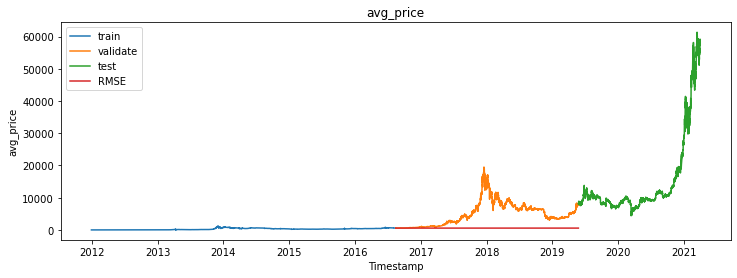

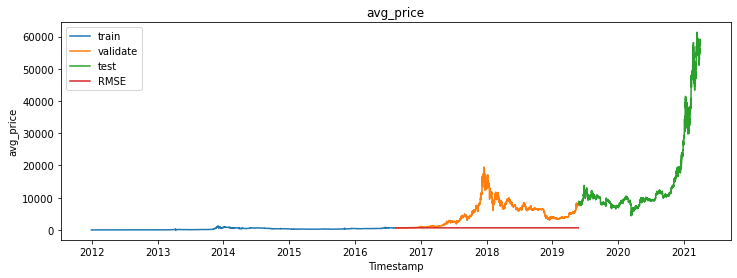

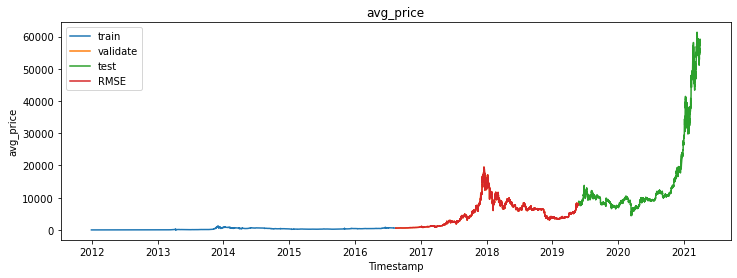

Bitcoin Price over Time

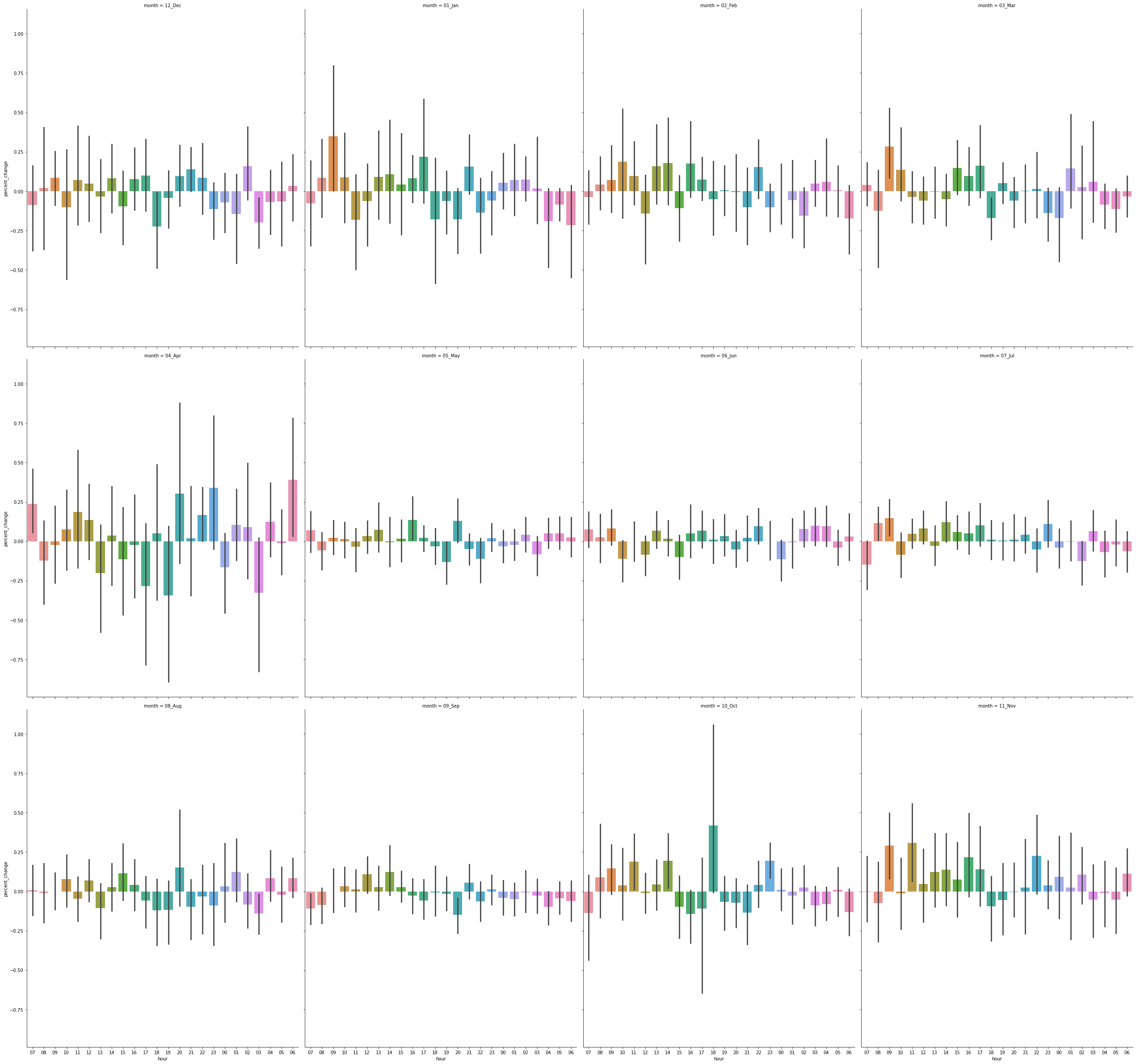

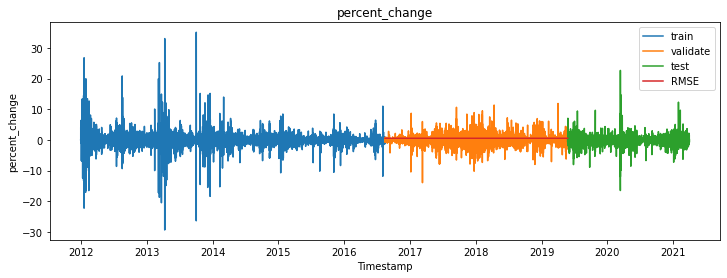

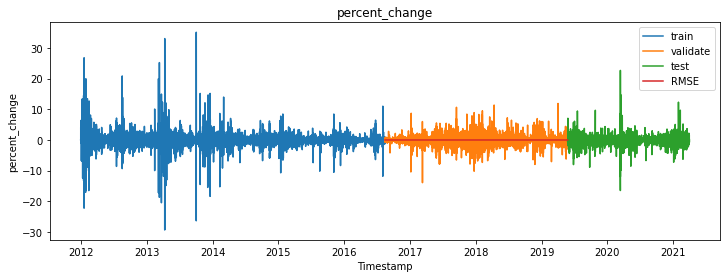

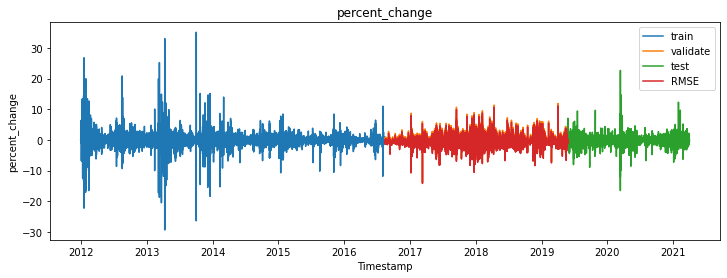

Hour vs Percent Change on a monthly basis

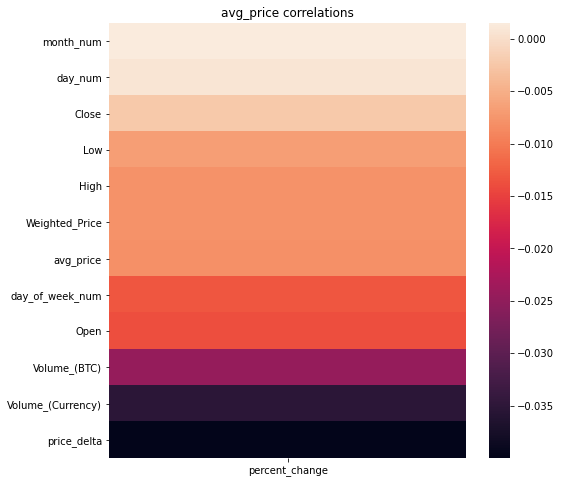

Correlations

Correlations of Average Price

| Column Name | avg_price |

|---|---|

| price_diff | 0.0061726 |

| percent_change | 0.00543991 |

| Volume_(Currency) | -0.0475418 |

| Volume_(BTC) | -0.067203 |

| price_delta | -0.142155 |

| day_num | -0.346819 |

| month_num | nan |

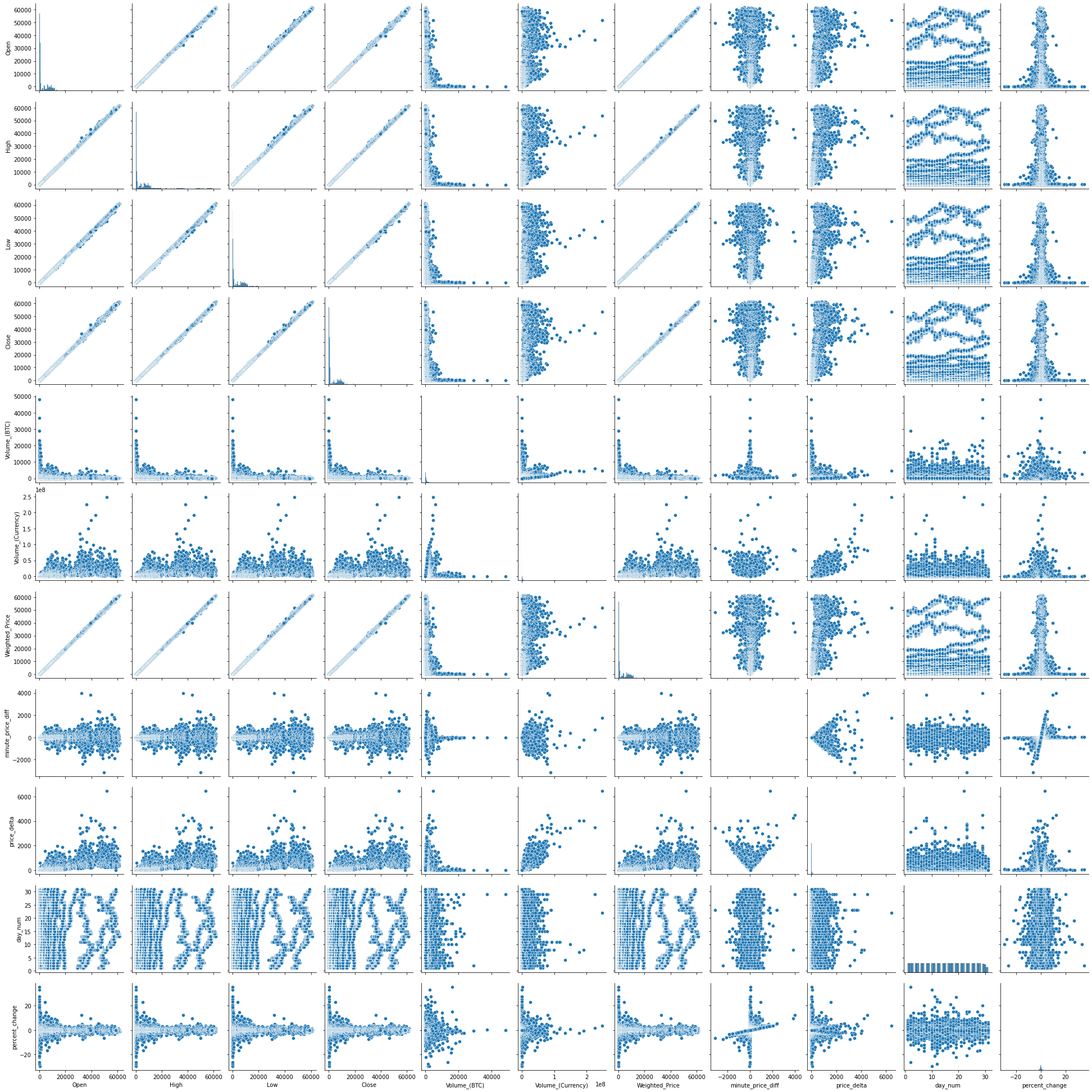

Pair Plot

Explore Takeaways

- It is apparent that the most correlated features with

avg_priceareday_num,price_delta,Volume_(BTC).- It also appears that the avg_price tends to trend upward during Oct, and downwards in Sept.

Modeling

✓ Plan ➜ ✓ Acquire ➜ ✓ Prepare ➜ ✓ Explore ➜ 🟢 Model ➜ ☐ Deliver

Last Observed Value

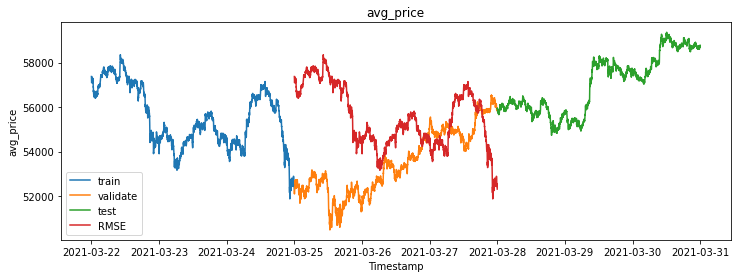

Average Price

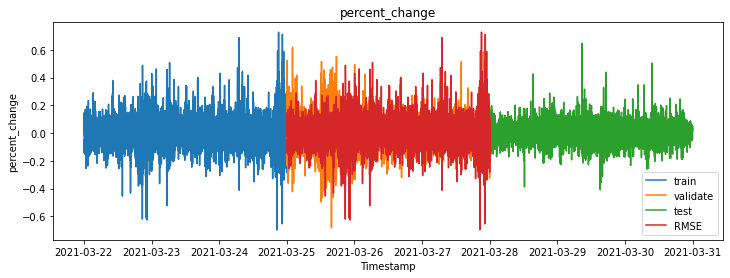

Percent Change

Rolling/Moving Average

Average Price

Percent Change

Holt’s Linear Trend

Average Price

Percent Change

Previous Cycle (6 months)

Average Price

Percent Change

Project Delivery

✓ Plan ➜ ✓ Acquire ➜ ✓ Prepare ➜ ✓ Explore ➜ ✓ Model ➜ 🟢 Deliver

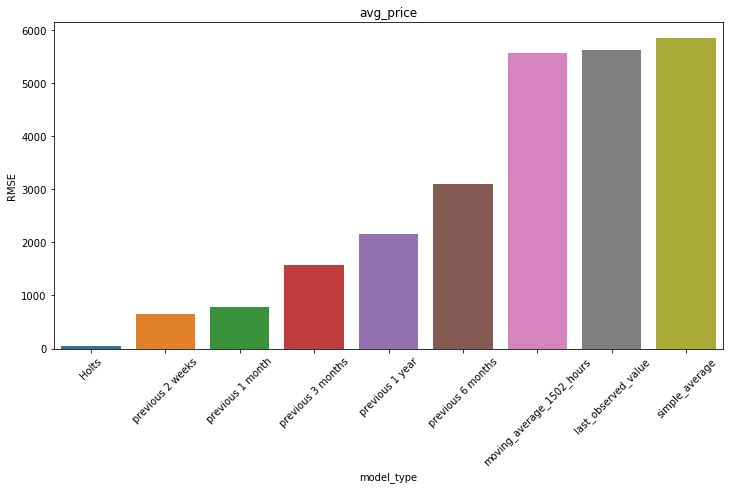

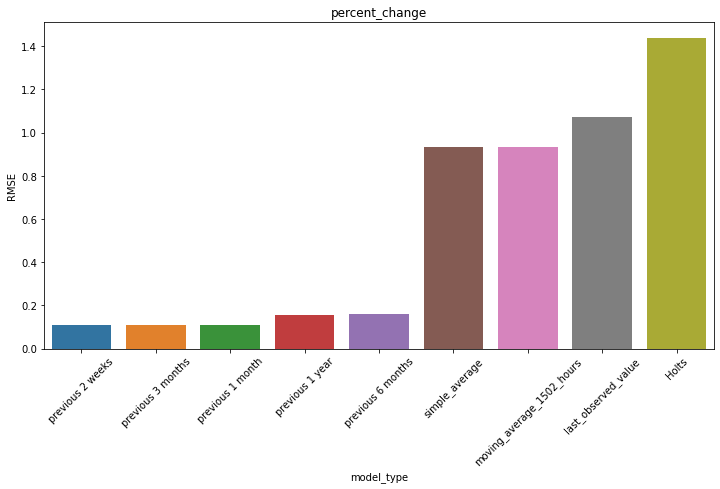

Root Mean Square Deviation Results

Average Price

Percent Change

Conclusions & Next Steps

- I found that there were large variations in certain models RMSE but the models that could be tuned (such as Holt’s and Previous Cycles) performed best after optimization.

- If I had more time to work on this project, I’d continue doing more performance tuning and possibly aggregating other external data factors that could provide a higher level of correlation or model accuracy.

Replication

- Download the the csv data from Kaggle here.

- Download the

acquire.py&prepare.pyfiles and then run the final notebook.